Tag: fiscal responsibility

The Foundation’s Gigi Hyland Named Financial Literacy Advocate of the Year

For her commitment to and active involvement in financial education, National Credit Union Foundation (the Foundation) Executive Director Gigi Hyland has been named 2018 Financial Literacy Advocate by Franklin Mint Federal Credit Union (FMFCU). She will be formally honored April 19, 2018 at the annual FMFCU Partners in Education Celebration, […]

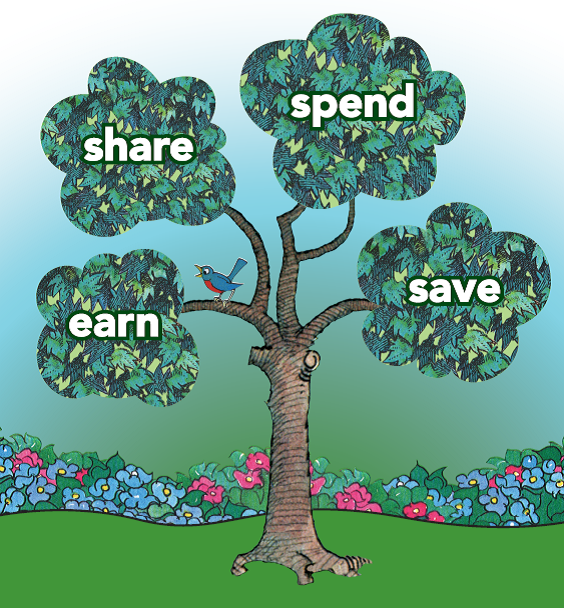

Coin Counters: A Tool To Teach Children Sound Money Management

Coin Counters are an integral part of a credit union’s youth program. They provide children with a goal to save money and a memorable experience when the coins are dropped into the machine, sorted, and deposited. Even very young children can understand the concept of saving money and watching it grow! […]

Credit Unions Make a Difference

by Chloe Niu, Wharton Student & FMFCU Intern Credit unions and banks have coexisted for a long time, each offering financial services to serve their respective members and customers. Recent directives for credit unions, however, have raised the age-old question of where distinction between credit unions and banks exists. The […]

Financial Literacy & The Bear Necessities

The Berenstain Bears Financial Literacy Program attracts attention in the UK and is featured in an article about Credit Unions in Co-operative News.

Mike Berenstain Named 2016 Financial Literacy Advocate

Berenstain Bears author to be honored April 28 in Drexel Hill, PA Mike Berenstain Partners in Education 2016 Financial Literacy Advocate Mike Berenstain, Author, Illustrator, and President of Berenstain Enterprises has been named 2016 Financial Literacy Advocate by Franklin Mint Federal Credit Union Partners in Education for his commitment to […]