Author: Rick Durante

Trouble With Money Books Available to All Credit Unions

This classic Berenstain Bears story is a perfect way to teach children about the importance of being responsible with money while promoting the value of credit union membership! Come visit Bear Country with this classic Credit Union Financial Literacy Series book by Stan and Jan Berenstain. Mama and Papa […]

Build your child’s money skills while you read

Build your child’s money skills while you read! Consumer Financial Protection Bureau (CFPB) offers the Money as You Grow Bookshelf offering resources for parents and caregivers and helps you bring money topics to life through story-time. Reading Guides for The Berenstain Bears’ Trouble with Money and The Berenstain Bears & Mama’s New […]

Online Information Sessions Available

Promote Financial Literacy and Credit Union Membership Join us for a no obligation online information seminar and learn how The Berenstain Bears Financial Literacy Program can help your credit union educate young members and attract family membership. Find out more about this fun and unique solution designed by credit unions […]

America Saves Week: Franklin Mint sets children up for financial success

America Saves Week: Franklin Mint FCU sets children up for financial success From https://www.nafcu.org/newsroom/america-saves-week-franklin-mint-sets-children-financial-success As part of America Saves Week, NAFCU is highlighting the efforts of member credit unions with strong financial education programs that encourage members to save and strengthen their personal finances. Today, see how Franklin Mint Federal […]

The Berenstain Bears Financial Literacy Program Expands to Florida!

Welcome Okaloosa County Teachers Federal Credit Union The credit union was chartered in February 1960 to serve the Okaloosa County School Board, Okaloosa Walton Junior College and St. Mary’s. It was formed with the help of a few local residents in north Okaloosa County, Florida. Today, Okaloosa County Teachers FCU […]

The Foundation’s Gigi Hyland Named Financial Literacy Advocate of the Year

For her commitment to and active involvement in financial education, National Credit Union Foundation (the Foundation) Executive Director Gigi Hyland has been named 2018 Financial Literacy Advocate by Franklin Mint Federal Credit Union (FMFCU). She will be formally honored April 19, 2018 at the annual FMFCU Partners in Education Celebration, […]

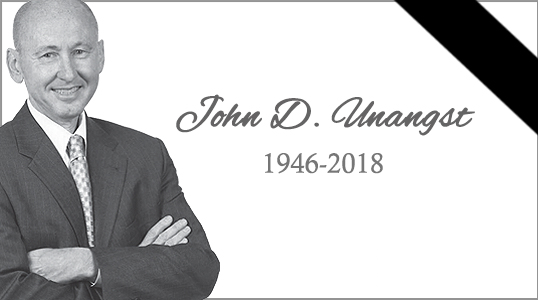

A Financial Literacy Legacy

John D. Unangst, President & CEO of Franklin Mint Federal Credit Union (FMFCU) and conceptualist of The Berenstain Bears Financial Literacy Program is fondly remembered as a visionary leader. John’s idea to initiate conversation with Berenstain Enterprises was the planted seed that continues to sprout. He knew such an exclusive […]

Get The Berenstain Bears’ Trouble with Money Credit Union Edition

Credit Union Network for Financial Literacy (CUNFL), the sole distributor of the credit union version of The Berenstain Bears’ Trouble with Money (Random House) is making this title available to all credit unions. Before now, this special edition of the 1983 classic was only available to credit unions participating in […]

Franklin Mint Federal Credit Union Announces the Passing of John D. Unangst

Below, please find an official FMFCU press release regarding this sensitive matter. Please direct questions to TomK@fmfcu.org. Chadds Ford, PA – Franklin Mint Federal Credit Union (FMFCU) announces the passing of President and CEO John D. Unangst over the weekend. Under his stewardship for over 40 years, Unangst led the […]